This post is Part 3 of The Modern Tog’s Photographer’s Pricing Guide series. Here’s the link to Part 1 of the Pricing Guide in case you missed it.

Running a business is expensive. Our next step is to consider all the tax-deductible business expenses that you expect to have in a year to make sure that we account for them in our pricing.

There are two main types of expenses, fixed and variable.

Fixed Expenses

The first type is something I’ll call “Fixed Expenses”, or expenses you’ll have whether you have 0 or 1000 shoots during the year. For example, your equipment costs, insurance, and other photography business necessities would go in this list. Add up all total fixed expenses for the year.

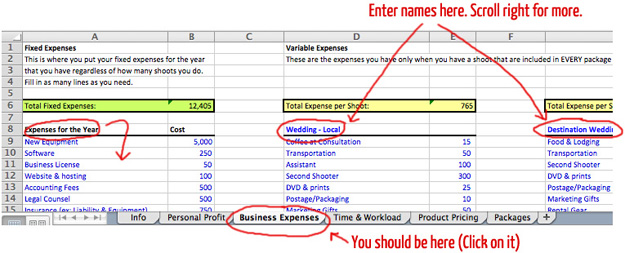

In the Photographer’s Pricing Guide Workbook, click on the “Business Expenses” tab at the bottom of the worksheet and simply enter the item and amount in the total fixed expenses list (columns A and B) and the total will be computed for you. There are a number of example items to help you think of expenses you may not have considered. Simply put “0” in for the amount if they don’t apply to you, or delete them. Feel free to itemize and add as many things as you like. (See image below).

Variable Expenses

The second type of expense is what I’ll call a “Variable Expense.” These are expenses that vary based on how many and what kind of shoots you do. These should be things that are ALWAYS included in the package and aren’t something that is optional in some packages but not available in others. For example, for every wedding you book you may spend money on travel, the consultation, rental gear, an assistant, and a DVD with packaging and postage. For portraits you may have expenses such as location shooting fees or assistant fees. Things like additional prints or albums would NOT be included here unless they are offered in every single shoot. Add up your average expense per portrait shoot and per wedding shoot. Do this for every kind of shoot that you do that has a different set of expenses.

In the Photographer’s Pricing Guide Workbook on the “Business Expenses” tab, enter the name of the different types of shoots that you do in row 8 (one per group). Then enter the expense item and amount in the table below. Each type of shoot will be added up for you. You can have up to 10 different types of shoots.

In the next part, we’ll look at your business projections and calculate how much you need to be charging for each type of shoot that you do.

Any questions so far? Leave a comment below and I’ll answer there. If you are wondering about something, chances are someone else is, too!